There are specific times of the year when you can enroll, disenroll, or switch from a Medicare Advantage Plan, also called Part C or MA Plans. These plans are sold by private insurance companies that are approved by Medicare. If you miss these enrollment periods, it may be hard to make changes to your coverage, or enroll in a new plan.

Initial Coverage Election Period (ICEP)

The Initial Coverage Election Period is when you are first eligible to enroll in a Medicare Advantage Plan. For most people eligibility begins when they turn 65. You are allowed to enroll anytime over a 7 month period. This 7 month period starts 3 months before you turn 65 and ends 3 months after your birthday month. This means if your 65th birthday is in May you have the ability to sign up from February through August.

The initial enrollment period is when you are eligible for Part A and Part B. If you delay enrolling in Part B, then your ICEP for Medicare Advantage will not take place until you enroll.

To be eligible you must:

- Have Medicare Part A and Part B

- Permanently reside in the service area of the Medicare Advantage plan

- Not have End-Stage Renal Disease (ESRD)

If you missed or did not utilize the ICEP, you can still join a Medicare Advantage plan during two other periods:

- Annual Enrollment Period (AEP)

The Annual Enrollment Period occurs every year from October 15 through December 7, with coverage beginning January 1. This period is also referred to as the Fall Open Enrollment. During this period, people who are eligible can enroll in a Medicare Advantage plan. You can also switch plans and add, drop or change prescription drug coverage during the AEP.

- Special Enrollment Period (SEP)

A Special Enrollment Period is a period when beneficiaries can enroll, or make changes to their Medicare Advantage plan outside of regular enrollment periods. If you qualify and get granted an SEP, your coverage will start the first of the month after you sign up. Certain situations are required to be eligible for a SEP, such as:

- Moving out of your plan’s service area

- Having full Medicaid coverage and Medicare

- Qualifying for a low-income subsidy program

- Tricked or misled into joining a plan

- Living in a nursing home, rehab hospital, or skilled nursing facility

- Enrolled in a State Pharmaceutical Assistance Program, or lose SPAP eligibility

- Joining a Medicare Advantage plan during your initial enrollment period when you turned 65. The first year is considered a trial period, so you can change to Original Medicare at any time within the 12 months.

- Receiving Extra Help to pay for your prescription drugs

In order to enroll in a Special Enrollment Period, you must apply and provide the necessary proof regarding the qualifying situation.

- 5-Star SEP

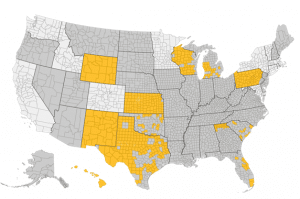

During the 5-star special election period, you can switch to a 5-star Medicare Advantage Plan from December 8 through November 30. The plan will go into effect beginning December 1. It is important to know that you can only use this SEP once per calendar year. After receiving your application, you will begin coverage the first day of the following month. To be eligible, you have to have Medicare Part A and B, and live in the service area.

What you can do during this period is:

- Drop Original Medicare and enroll in a 5-star Medicare Advantage plan.

- Switch from any Medicare Advantage plan to a 5-star Medicare Advantage plan.

- Switch from a 5-star Medicare Advantage plan to a different 5-star Medicare Advantage plan.

Medicare star ratings are updated every fall on Medicare.gov.

Medicare Advantage Disenrollment Period (MADP)

Another different kind of enrollment period is the Medicare Advantage Disenrollment Period. This period occurs from January 1, to February 14 every year. This is when you can drop your current Medicare Advantage plan and switch to Original Medicare with or without adding a stand-alone Medicare drug plan (Part D). You cannot enroll in a Medicare Advantage plan, or switch to another Medicare Advantage Plan during this period, only drop a MA plan.

Shopping around will help you save money while finding a plan that best suits your needs. Research has shown that people with Medicare Advantage Plans could lower their costs just by shopping plans every year. EZ.Insure can help you shop around and compare different Medicare Advantage plans in your area. You can speak to one of our agent’s one on one without any hassle or obligation. To get started, just call 855-220-1144, email at replies@ez.insure, or simply put your zip code in the bar below to get quotes. The process of choosing a plan or signing up should not be difficult, make easy for you.