Plans will be at least 34 percent higher in 2018 due to Trump’s decision to halt cost-sharing subsidy payments to insurers.

Because the Trump administration ceased these cost-sharing payments to insures, insurance companies raised premiums to compensate for the loss of these reimbursements. This termination of subsidies has also caused some insurers to drop out of the marketplace, leaving regions with only one insurer.

The changes

Silver plans pay for about 70 percent of customers’ health costs, with the remainder of payment left for the customer. These plans are purchased by nearly 80 percent of customers. The cost of silver plans is increasing an average of 34 percent next year.

Bronze plans, the second most popular plan, covers 60 percent of customers’ health costs. These plans are purchased by about 23 percent of customers. The cost of bronze plans is increasing an average of 18 percent in 2018.

Gold plans are usually the priciest, covering 80 percent of customers’ health costs. These plans are purchased by about 3 percent of customers. This year, the cost of gold plans are increasing an average of 19 percent.

Platinum plans are the most expensive plans, covering 90 percent of customers’ health costs. These plans are purchased by less than 1 percent of customers. The cost of platinum plans is rising by an average of 24 percent next year.

Gold plans usually have higher monthly plans and lower out of pocket costs than silver plans, but that has now changed. Now silver plans are more expensive than the gold plans that have lower deductibles.

Who this will affect

Customers who will be affected by these price increases are those who must purchase Obamacare because they do not have insurance through employers or Medicare. People who qualify for government subsidies will benefit from the premium increase of silver plans. As the premium increases for next year, enrollees will receive higher premium tax credits, allowing them to have a plan with a lower deductible, copays, and less out of pocket spending.

However, people who do not qualify for government subsidies will have to pay more for a silver plan. The least expensive gold plan for next year will be cheaper than the least expensive silver plan. So many people will probably opt to purchase the bronze or gold plan next year.

If you make more than the poverty line, in some states, a gold plan will cost less and have a lower deductible. Also, a high deductible bronze plan will have lower premiums. For example, a 40-year-old individual making $30,000 and eligible for a tax credit will pay 54 percent less in 2018 for their premium of the lowest-costing bronze plan, 9 percent less for the lowest-costing silver plan, and 16 percent less for the lowest-costing gold plan.

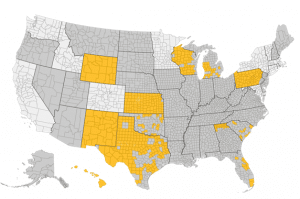

Gold plans are a better option in some states such as Pennsylvania, Wyoming, New Mexico, Kansas and Texas. Below is a map of highlighted states where gold plans are lower than silver plans by $25 or more.

Need Help?

Comparing plans for the upcoming year, and choosing one can be difficult. EZ.Insure can help you compare all the plans in your area, and assist you in choosing the ideal plan. Whether gold or silver is the cheapest, or bronze or platinum will suit you, EZ.Insure will make it an easy decision. Enter your zip code in the bar above to receive instant quotes in your area. You can also email replies@ez.insure or call 888-350-1890 to get started!