There are many benefits that come with running your business from home. This includes convenience, flexibility as well as comfort. With all this being said, many home-based business owners don’t consider the risks associated with running an organization from their house. This poses the question — “Do I actually need insurance for my home-based business?”

While you may scoff at the question at first, thinking it’s unnecessary, the truth is that just like any other business, having the proper coverage provides essential protection safeguarding everything you’ve worked for. But don’t just take our word for it. Instead, to help you make an educated decision about your options, we’ll delve into five critical questions to ask yourself. When it’s all said and done, you’ll have a solid understanding of why home-based business insurance is so essential.

Question #1: Do You Have Expensive Inventory or Equipment?

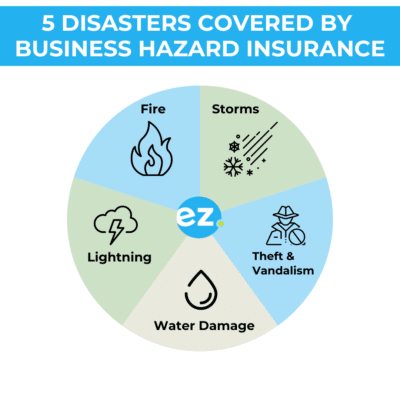

One of the first things to think about is whether or not your home-based business involves inventory or expensive equipment. Your homeowners’ insurance probably doesn’t cover business-related objects in the case of damage, theft, or loss, even if you work from home.

Think about things such as your laptop, tools, technology or any other equipment that’s vital to your business operations. Then consider any inventory. Do you sell goods? If the answer is yes, these items could also be in danger without the proper protection. In the unfortunate case of a fire or break-in, you may have to replace these valuables out-of-pocket.

Why This Question is Important

- Your operation relies on your inventory and/or equipment and without it your business is probably not functional.

- Without home-based business insurance, replacing these items may be very expensive or unaffordable.

- Homeowner policies alone usually don’t cover inventory or equipment losses.

Question #2: Do Clients or Customers Ever Visit Your Home?

Do you ever hold meetings at your house office with customers or clients? If so, you might be putting yourself in danger for responsibility if an incident occurs. For instance, you can be liable for a client’s medical costs if they trip and fall on your property, leading to an expensive lawsuit.

General liability insurance covers property damage and physical injury claims made by third parties. Even if your place of business is your house, this type of coverage it’s still necessary for any company that deals with clients or consumers face-to-face.

Why This Question is Important

- Hosting clients without the proper home-based insurance leaves you liable in the case of an injury

- General liability coverage will take care of the costs of lawsuits or claims relating to an accident, so you won’t have to pay out of pocket.

- Having general liability coverage puts clients at ease and bolsters your reputation as a responsible business owner.

Question #3: Could a Lawsuit Affect Your Financial Stability?

If you own a small business and are on a strict budget, a lawsuit could be extremely detrimental to your business. Even a small claim could have a huge negative impact. In addition to an injury-related incident, clients may also file lawsuits if they think you’ve committed a professional error or if they feel you failed to provide a promised good or service.

Unfortunately, the legal and court costs stemming from these types of situations can add up quickly and jeopardize your finances. That’s why it’s so crucial to consider investing in professional liability coverage on top of the general liability protection that we discussed above.

Why This Question is Important

- Small businesses suffer far more than large corporations in the result of lawsuits since they generally don’t have nearly as much funds or resources.

- Professional liability coverage takes care of legal fees, court fees, and other payouts associated with a business error.

- Without coverage, a lawsuit could be so expensive that you’re forced to sell your assets.

Question #4: Do You Rely on Your Home-Based Business for Income?

If your home-based business is your main source of revenue, you should think about how an unplanned disruption could affect it. What would happen if your home was damaged by a fire, a natural disaster, or some other unanticipated incident that prevented you from using it for several weeks or even months?

Business interruption insurance acts as a safety net paying for lost income during these unexpected down times. This coverage guarantees that, even while your business is recuperating you can continue to fulfill your financial and client obligations, pay your bills, and provide for your family.

Why This Question is Important

- Without business interruption insurance, an unexpected event may force your business to shut down entirely, therefore bringing your income to a halt.

- This coverage oftentimes provides relief in the form of a new, temporary space to operate out of.

Question #5: Do You Use a Vehicle for Business Purposes?

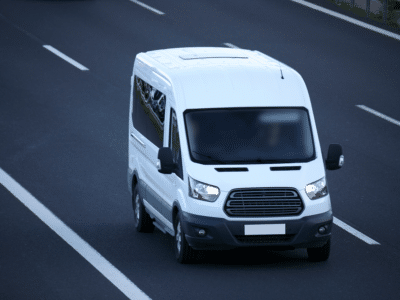

While this question isn’t directly related to your home, many remotely-based entrepreneurs utilize vehicles in their day-to-day operations. Unfortunately, if you’re regularly using a car, truck or van for business purposes, your personal auto coverage probably won’t cover it.

Consider tasks such as delivery, client visits, or inventory transportation. If any of these are applicable to your company, and you aren’t properly covered, you’ll be financially liable for any accidents on the job. This is where commercial auto insurance comes in, protecting your business vehicle in the case of an accident during the work day.

Why This Question is Important

- When using a vehicle for purposes related to your business, personal car insurance policies will not be enough.

- If an accident occurs while you’re conducting business, you won’t have to pay out of pocket.

- Without commercial auto insurance, you’ll be held liable for any vehicle damage, personal injuries or lawsuits stemming from the accident.

Final Thoughts on Home-Based Business Insurance

If you run a business from the comfort of your house, investing in home-based business insurance is crucial. Even if you still aren’t sure whether it’s necessary for your organization or not, just review the five questions listed above. If your answer to any of these questions is yes, home-based business insurance is likely a smart investment.

It’s important to get ahead of potential risks before they actually take place. If you decide not to, it could cost you an exorbitant amount of money, or even your entire business. So don’t wait for any surprises, instead, take time to review your coverage options, and find a plan that best fits your small businesses needs.

Visit EZ.Insure For Your Business Insurance Needs

We understand that shopping for business insurance isn’t fun and it can be confusing too. Luckily for you, there’s a platform that makes finding insurance quick and easy. We’re of course talking about EZ.Insure. At EZ we pride ourselves on the seamless, simple platform that we’ve built out. All you have to do is enter your ZIP code and in a few minutes you’ll be matched with a customized insurance quote for free! We also have side-by-side plan comparison tools so you can be sure to find the perfect coverage. To get started, fill out the form above or call us directly at 855-694-0047 to get started!