You’ll be surprised to learn that having the right coverage can save you hundreds to thousands of dollars per year. Of course, how much you can save will depend on factors such as the type of business you run, the number of employees you have, and whether you bundle your policies. Regardless of the variables that will affect how much you pay; you should know that skipping commercial insurance is always a waste of money.

Jump To:

-

What Is Commercial Insurance and Why Do You Need It?

-

Types of Commercial Insurance

-

How Much Do Commercial Insurance Policies Cost?

-

How EZ Can Help

What Is Commercial Insurance and Why Do You Need It?

All small businesses need commercial insurance. The various policies available to you will protect you from common financial losses such as property damage, theft, liability, and employee injury. Having the right insurance coverage will mean that you and your business can recover from these types of losses more easily.

In fact, you risk going out of business if you don’t have the right commercial insurance. This is because if you do not have the proper insurance, you may have to pay for the above types of claims out-of-pocket. Many small businesses lack the resources and capital to cover these types of claims, which means that uninsured businesses frequently fail as a result of claims.

And why are there so many different types of commercial insurance? Each type of commercial insurance protects a different aspect of your business. They all work together to ensure that you have full coverage, and your business can continue to grow no matter what happens. It can seem a bit daunting when you start looking into all the different types of commercial insurance, but EZ is here to break down the types of policies, so you can figure out what your business needs.

Types of Commercial Insurance

Let’s start with the different types of commercial insurance and how they can save you money.

General liability

A general liability policy protects your small business from claims of bodily harm and property damage. While you obviously do your best to avoid these dangers, they can still arise during normal business operations. They can be very costly, and as a small business, you might struggle to find the financial resources to cover a liability claim.

For example, let’s say a lawn care company sells a client a bottle of organic pesticide, and the client inhales the pesticide vapors by accident while applying the pesticide and suffers a severe allergic reaction. The client then seeks $100,000 in medical and other damages from the lawn care company, which could bankrupt the small business. This is where general liability insurance comes in.

This type of policy will cover:

- Costs for property damage claims against your business

- Medical expenses if someone gets injured at your business

- Administrative costs to handle covered claims

- Court costs, judgments and settlements for covered claims

Professional liability

Professional liability insurance, also known as errors and omission, or E&O, covers any damages resulting from claims of negligence or misconduct. In other words, if you make a mistake — or are presumed to have made a mistake — and your client endures a loss as a result, and sues you, your professional liability insurance policy will protect you from the financial consequences.

It’s important to have this type of policy if your business offers a service or advice, since lawsuits of this nature can easily cost between $10,000 and $100,000, depending on the length and complexity of the dispute. As well as your client’s willingness to settle.

These lawsuits are so costly because they involve multiple types of fees. For example:

- Lawyers will generally charge between $150 and $400 per hour for the time they spend on your case.

- Your legal team will also bill you for administrative costs such as copying, data processing, shipping, and travel expenses.

- You will have to pay court costs for certain filings and hearings.

- You may have to pay thousands of dollars to expert witnesses to explain a technical aspect of your argument.

- If you lose at trial, you may be required to pay a settlement to avoid going to trial or a court-ordered judgment.

Business Owner’s Policy

A Business Owner’s Policy (BOP) combines commercial property and liability insurance. The general liability portion of a BOP protects your company in the event that someone files a claim against you or your company. As pointed out above, general liability protects you from lawsuits caused by things like a customer slipping on a wet floor, a defective product causing property damage to a client, or claims that the products or services you provided caused injury. It can also shield you from libel, slander, and other legal claims arising from advertising.

The property insurance element of a BOP protects business property that you own, lease, or rent. Such as buildings, equipment, furniture, and inventory. It assists in the repair or replacement of stolen, damaged, or destroyed property. Including property that is not yours but is in your care. It can also cover income loss and covered expenses such as rent, payroll. As well as other financial obligations while your property is being repaired or replaced following a fire or other covered loss.

Bundling policies with a BOP lets you get all of the coverage you need at a discounted price, while fully protecting you from having to pay for any losses or legal fees out-of- pocket.

Workers’ compensation insurance

Workers’ compensation insurance will cover your employees’ medical bills and lost wages if they are injured on the job. It also covers them if they become ill as a result of working conditions. It even pays death benefits to employee’s dependents if the employee dies as a result of a work injury or illness. Having this type of insurance will generally release you from being liable for paying those expenses out-of-pocket.

Not only that, but most states require you to carry this type of insurance. So, if you choose to forgo it, you’d also have to pay fines for not having a policy. Every state has its own set of rules for this type of insurance. Make sure to check our state pages to see what the rules are in your area.

Commercial auto insurance

Commercial auto insurance helps to cover the costs of accidents involving your company’s vehicles. If you are sued as the result of an accident, medical bills, property damage, and legal fees will all be covered by your policy. In addition, some policies provide coverage for vehicle theft, vandalism, and other types of damage. Without coverage, any expenses related to these types of issues would be your responsibility.

How Much Do Commercial Insurance Policies Cost?

There are a lot of factors that go into the cost of each type of commercial insurance policy. Simply put, the cost of your insurance depends on what your company does and how much of it it does. Depending on the nature of your business, you may need to purchase several different types of additional coverage. For example, if you have delivery vehicles, you’ll need commercial auto coverage.

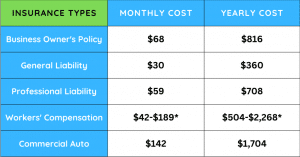

To give you an idea of what different types of commercial insurance can cost we’ve compiled a chart of the estimated average cost for each.

One of the factors that will affect the cost of your commercial insurance policies is their coverage limits. Which you can choose when purchasing your policies. An occurrence limit will be included in all insurance policies. Certain policies, such as liability insurance, may contain an aggregate limit.

- The occurrence limit specifies the amount of coverage available for a single claim.

- The aggregate limit is the most money your insurance company will pay out during the policy period. As pointed out, an aggregate limit is typically included in most liability policies.

For instance, your general liability policy may provide coverage of “$1 million/$2 million aggregate.” This means you will be allowed up to $1 million in coverage for a single claim. But the most your insurer will pay during the policy period will be $2 million.

Having a higher policy limit can increase the cost of your general liability insurance or errors and omissions insurance. In general, the higher your aggregate limit, the higher your premium.

The amount of coverage you choose will also affect the cost of your insurance. Certain characteristics of your company may also play a role. For example, if you have more employees, your workers’ compensation costs will rise.

How EZ Can Help

The various types of commercial insurance policies you require may appear expensive. But it’s important to consider their value and how much you’ll save in the long run. When you compare the overall cost of the policies to the consequences of not having coverage, such as losses, lawsuits, medical bills, and fines, it clearly pays to have coverage. Paying for all of that out-of-pocket can bankrupt a business, especially a small one! That means that not only would you lose money, but you might also lose your livelihood. Protect yourself and your business by purchasing commercial insurance today.

Whether you’re looking for a BOP policy, a commercial auto policy, or any type of commercial insurance, EZ can help. Our agents work with the top insurance companies nationwide to make sure you find the best insurance for your business. In fact, we can save you hundreds of dollars a year by working with your budget to find the best coverage. If you have questions, feel free to give us a call at 877-670-3538.