It is no secret that, on average, women live longer than men do. In fact, women’s life spans are almost 8% longer on average than men’s life spans. So does this make a difference when it comes to buying life insurance? In general, yes: life insurance companies know these stats, and typically view men as a higher risk to insure than women. So how much more can men expect to pay? And what determines their rates?

Why Men Are More of a Risk

As stated above, men usually pay more for life insurance because they are seen by life insurance companies as a higher risk to insure than women. Studies not only show that men tend to die at a younger age than women, but that they also tend to live riskier lives than women, engaging in more high-risk activities such as racing and adventure sports. These types of hobbies can mean higher rates when trying to purchase a life insurance policy.

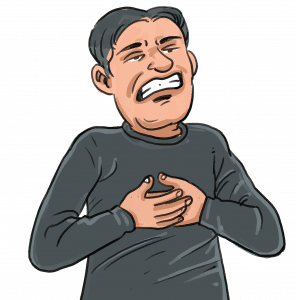

Studies also show that men are more likely to suffer from certain health conditions, like heart disease, diabetes, stroke, and cancer. In addition, according to statistics from Mountain Ice:

- Men are nearly 10 times more likely to develop inguinal hernias than women, and five times more likely to have aortic aneurysms.

- American men are more than three times more likely than women to develop kidney stones, become alcoholics, or have bladder cancer.

- Men are about twice as likely to suffer from emphysema or a duodenal ulcer.

- 1 in 2 men are diagnosed with cancer in their lifetime, compared to 1 in 3 women.

- Men are more likely to develop oral and throat cancer, as well as periodontal (gum) disease.

- 33% of men aged 20 and over have hypertension.

- 36.6% of men aged 20 and over are obese.

- Men are 1.5 times more likely to die of heart disease, cancer, and respiratory disease.

- Men are three to seven times more likely than women to commit suicide.

- Men live on average five fewer years than women.

And not only are men more likely to develop these health conditions, but they are also less likely to visit their doctor and stay on top of their health. Consider this:

- Women are 33% more likely to seek outpatient care.

- The rate of non-illness care visits by women is 100% higher than that of men – this means that women are 100% more likely to visit the doctor than men!

- Women ages 15-44 visit the doctor 56% more often than men in the same age category.

- Men are 40% more likely to skip recommended cholesterol screenings.

- 57.6% of men aged 18 and over meet the federal physical activity guidelines for aerobic activity.

- 12% of men aged 18 and over are in fair or poor health.

- Men account for 55% of the workforce but 92% of workplace deaths.

Find An Affordable Rate

These statistics might seem overwhelming, but they show why men are seen more as a risk by insurance companies. But despite all this, affordable life insurance is never out of reach! If your hobbies are not overly risky, and probably won’t get you hurt or killed, and if you live a relatively healthy lifestyle, you can find a great affordable policy. And having a life insurance policy will mean you will be able to provide your family with a financial security net in the event of your passing.

There are many different kinds of life insurance policies to choose from, including whole life insurance, term life insurance, and final expense insurance, so if you’re not sure where to begin, consider using online tools, or speaking with an agent. The right policy for you is out there! We have provided the top insurance companies that offer life insurance policies below; each can give you hassle-free assistance and the most competitive rates in the nation. Always check multiple sites to make sure you have bargaining power and know the advantages of each company. Make sure a hard time isn’t made harder by a financial burden, check life insurance rates today.