Let’s face it, the pandemic has put a lot of strain on small businesses, many of whom are now struggling to survive. If you’re a small business owner, you might have had to let some employees go, shift around their duties, or even consider shutting down for a while. All of this will have changed the way your business operates, and you might have to work to get it back to how successful it was previously. There is no doubt that at this time you will want to save as much money as you can, and this probably includes looking for ways to save on commercial insurance. It is possible to focus on rebuilding your business while saving on commercial business policies, including worker’s compensation insurance, with help from an EZ agent. Here are some tips to consider when rebuilding.

Assess The Damage

Unfortunately, your business might have experienced a lot of financial hardship in the past year. You’re not alone: many businesses have had to take a loss during the pandemic. Assess the damage by comparing this year’s numbers with last year’s, and considering your total assets. Include the impact of losing employees and reducing their hours or changing their roles. Remember, with changes in operations or employee positions come changes to your commercial insurance policy. You might need to lower your liability limits, change your worker’s compensation policy, or change/add policies.

Reconsider Your Business Plan

The business plan that you had pre-pandemic is most likely looking a lot different right now. Focus on a new business growth model, whatever that might mean for your particular business. Do you need to focus more on marketing? Hire more employees? Make changes to how your business is run?

Consider A Loan

If you took a huge financial loss, consider looking into a loan. There are many small business loans (SBAs) you can consider, including the government’s pandemic-related Paycheck Protection Program, which provides funding to help business owners keep their employees. Getting a loan can help you invest in your business, or keep you afloat while you create a new business plan.

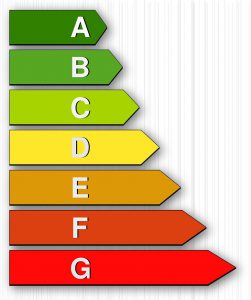

Save On Business Insurance

As mentioned, when you lose employees or shift their positions, it can completely change how much you pay in premiums for worker’s compensation insurance. You could be spending more than necessary, and the same goes for your commercial insurance policies. You want to make sure that you are properly covered, and if you have changed how your business operates, you need to do the same for your commercial insurance policies!

Develop A Time To Rebuild

Understand that it will take some time rebuilding your business back up to what it used to be. Take your time and create a realistic timeline for your priorities. Just remember to add protecting your business to the top of that list!

If you are interested in comparing commercial insurance policies, an EZ agent can help. With us, you will work with one agent in your area who deals with the nation’s top-rated insurance companies. We will assess your company’s needs and make sure that, as you focus on rebuilding, you are completely covered. To get free instant quotes, enter your zip code in the bar above, or to speak to a licensed agent, call 888-615-4893. No hassle or obligation.