If you own a business, commercial insurance is a must. Depending on the type of business you own, you could need a number of different commercial policies. Having all of these different policies can come with a hefty price tag. The bad news is there’s no getting around having commercial insurance; just one mistake could lead to a lawsuit and even the loss of your business. The good news is that there are things that you can do to reduce the cost of your commercial insurance, and keep the future of your business secure.

Assess What You Really Need

Commercial insurance is 100% necessary, but you should really look at which policies are right for your business, so you know you’re protected but not overspending. The first type of policy to consider is property insurance to protect your building and its contents. If you have employees, you will need worker’s compensation insurance to protect you in the event that an employee gets hurt on the job. You will also most likely need general liability coverage to protect against lawsuits.

After purchasing those three major types of policy, you can determine whether you need other policies like cyber or professional liability insurance. Cyber liability will protect you in the event of a data breach, and professional liability will cover you in the event of an unfulfilled contract, mistake that leads to a client’s financial loss, etc.

No-Lapse Coverage

If you have a business that goes through slow seasons, it may be tempting to drop your insurance coverage when you hit a slow down. But you should know that doing so can have consequences. For example, if you continually drop your insurance, and then pick it back up when sales increase again, insurance companies will think twice about covering you. It is important to remain consistent in the eyes of the insurance company you’re working with. Not only that, but going through a slow season doesn’t mean that an accident or damage can’t still happen to your business! Keep your policies year round so you never have to worry about coverage.

Classify Employees Properly

When you purchase workers compensation insurance, each of your workers need to be assigned a workers compensation classification code based on the type of work they perform. Your insurance company will use these codes as part of their formula for determining how much to charge you for your policy. Make sure your employees are classified correctly, otherwise you could end up paying higher premiums than necessary.

Security Is A Must

If, like most businesses, your business operates online, you have a lot of your customers’ sensitive information in your hands – and they expect you to protect it. To protect their information from security breaches, and your business from lawsuits and reputational damage, make sure you’re doing all you can to minimize the risk of cyber crime. Upgrade your systems, use VPNs, and talk to your insurance agent about cyber liability insurance.

Bundle Policies

As we mentioned above, your business will probably need at least general property and liability policies to be sufficiently covered. You might also need a few other types of policies. If you are looking to buy multiple policies, consider bundling to save money. Purchasing a business owner’s policy (BOP) can be cheaper than buying different policies individually.

Reduce Risks

If you want lower insurance rates, you will have to reduce risks within your business. If your insurance company sees your business as high risk, they will charge you more for your premiums. However, if you constantly train your staff, make sure that your business is clean and safe, and do everything you can to minimize claims, you can lower your premiums.

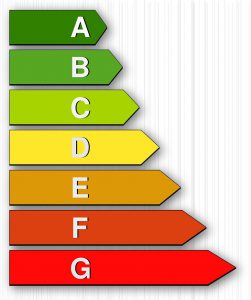

Opt For A Higher Deductible

Policies with higher deductibles have lower premiums. If you are looking for ways to save, consider opting for a higher deductible insurance plan to save on your monthly bill. Remember, though, to continue to minimize the risk of claims so you won’t have to worry about meeting your higher deductible.

Compare Plans

The best way to save the most money is by comparing all of your options. To do this quickly and easily, speak with an EZ agent, who will assess exactly what you need for your business. EZ.Insure works with all of the top-rated insurance companies in the country and can compare quotes instantly for you. One of our licensed agents will work with you to review your needs, and guide you through the whole process, at no cost to you. You could end up saving thousands of dollars a year just by working with one of our agents!. To get free instant quotes, simply enter your zip code in the bar above, or to speak to one of our agents call 888-615-4893.