No matter your age, choosing a life insurance policy is an important step in planning for your future. But qualifying for life insurance can be difficult if you’re older or in poor health. So if you’re in this situation, you would naturally want to find a simpler way to get yourself covered. No-exam life insurance can help speed up the process and cover you when other policies won’t. But is a no-exam life insurance policy worth it?

What Is No-Exam Life Insurance?

Usually, insurers require you to undergo a medical exam so that they can get an overview of your general health, and know how much of a risk it would be to insure you. They want information like your height, weight, and blood pressure to get an accurate read on the state of your health. But there are policies, known as no-exam life insurance policies, that allow you to skip the medical exam.

In most cases, though, no-exam does not mean no health questions. Most insurance companies who offer these plans will require you to fill out a health questionnaire. This helps them get at least some baseline information about your health.

Another benefit of no-exam policies is, while traditional policies can take weeks or even months to go through an underwriting process, no-exam policies are usually approved in around a week, and in some cases in only a few minutes.

What Types of Policies Are Available without an Exam?

No-exam policies have become popular in recent years, with insurers offering more and more options. The most popular choices are:

- Simplified issue life insurance – These policies let you skip the exam, but you will have to fill out a health questionnaire. They will ask you about your and your family’s health history, your smoking history, recent hospitalizations, and drug usage. Most of these policies will only cover you up to $100,000, depending on your answers.

- Guaranteed issue life insurance – This type of policy is usually only offered to those between 50 and 80-year-old, but you are guaranteed coverage if you meet the insurer’s age requirements. That means there is no medical exam and no questionnaire. These policies are best for those who don’t qualify for regular life insurance due to a terminal illness or age. And they usually have a coverage limit of $25,000.

- Accelerated underwriting life insurance – With this type of policy, insurers use technology to quickly decide whether to offer you coverage. Instead of a medical exam, insurers will use an algorithm to assess your possible risk for these policies. The algorithm will analyze data from things like your motor vehicle record, prescription drug history, and even your credit report. All of these factors determine how much of a risk you are to insure. But if you’re a generally healthy person you can be approved for up to $1 million in coverage without having to wait through a long underwriting process.

It’s important to note two things about no-exam policies. First, they usually only cover death from natural causes, although some can offer coverage for accidental death, as well. Second, because your insurer will be taking a bigger risk insuring you, your premiums will be higher than they would be with a traditional policy.

Is No-Exam the Right Option for You?

Everyone is different, and your life insurance should reflect your specific needs. No-exam life insurance can be worth it if you’re older, a smoker, or have a terminal illness. Any of these factors can raise your premiums, or even disqualify you from getting a traditional policy.

Even if you are young and healthy, a no-exam policy can still be right for you. For example, if you have a busy schedule and can’t squeeze in a check-up, or if you have a fear of needles, you might want to check out one of these policies. Even if you just like the convenience of getting coverage without having to leave the house, one of these policies can work for you.

The bottom line is a no-exam life insurance policy is not right for everyone. But this type of policy will get you covered quickly without being invasive. No-exam policies can ensure that you get the coverage you need regardless of age or medical history. You should check with your insurance company to see what you qualify for. And weigh the pros and cons to better help you decide what is best for your situation.

To get more information, and for help choosing a no-exam policy, look below. We’ve compiled a list of the top insurance companies who specialize in life insurance. You can skip the medical exam, but don’t skip comparing multiple insurance sites to find the best fit for you.

Co-written by Brianna Hartnett

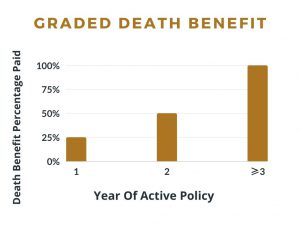

One of the major differences between graded death benefit policies and other types of policies is that the death benefits are paid out in percentages; after each year of having an active policy, your beneficiary will receive a higher portion of your death benefit:

One of the major differences between graded death benefit policies and other types of policies is that the death benefits are paid out in percentages; after each year of having an active policy, your beneficiary will receive a higher portion of your death benefit: