You’ve probably heard of Tuberculosis (or TB): you might have been vaccinated against it, if you have children, you might have had to get them vaccinated before sending them to school. And depending on your job, you might even get tested for it annually. But you’ve probably never had it, or even known anyone who has had it, since it is not that prevalent in the U.S. It is a pretty serious disease, though, so this World Tuberculosis Day (March 24), let’s take a deeper look at this disease, what causes it, and why it is so important to get vaccinated, or treated immediately if you do contract TB.

What is Tuberculosis?

Tuberculosis is a highly infectious bacterial disease that primarily affects the lungs, but it can also affect other parts of the body, such as the brain, kidneys, or spine. According to the World Health Organization, 1.5 million people died from tuberculosis in 2020, making it the 13th leading cause of death globally. Currently, it is the second main cause of death by an infectious disease, after Covid-19. It is a curable and preventable disease, under the right conditions.

Causes & Risk Factors

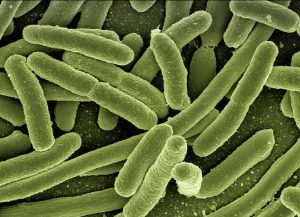

Although tuberculosis is a bacterial infection, and not a virus, it is transmitted by airborne particles. The bacteria that causes TB, M. tuberculosis bacteria, is spread through droplets expelled by sneezing, coughing, laughing, etc.

In most cases, people who become infected with TB can no longer transmit the bacteria after receiving the appropriate treatment for at least 2 weeks. It is important to note that people with well-functioning immune systems might experience what is known as latent TB, meaning they do not experience symptoms even though they have contracted the disease.

On the other hand, people with weakened immune systems are more likely to develop active tuberculosis. Risk factors that can weaken the immune system, making you more susceptible to tuberculosis, include:

- Diabetes or end-stage kidney disease

- Head and neck cancer

- Using tobacco products or alcohol for long periods

- HIV or any other immune system compromising disease

- Malnutrition

- Substance abuse disorders

- Medications that suppress the immune system

- Travel to regions with high tuberculosis rates, including India, Mexico, China, parts of Russia, some Southeast Asian islands, and sub-Saharan Africa.

Diagnosis

Tuberculosis can be identified by a few different tests, including a skin test, a blood test, or both. If you experience symptoms or know that you have come in contact with someone who has tuberculosis even if you aren’t experiencing symptoms, it is important to go get tested right away. A healthcare professional will ask about any symptoms, as well your medical history, and will listen to your lungs, check for swelling in your lymph nodes, and then conduct a skin test and/or blood test.

For the skin test, your doctor will inject a small amount of protein under the top layer of your skin; after two to three days, they will check for a welt on your skin at the injection site, which indicates a positive result. If you have a health condition that could affect your response to the skin test, your doctor might recommend that you first get a blood test.

How TB is Treated

If your tuberculosis test comes back positive, you will be prescribed antibiotics, which you will need to take once a week for 12 weeks. But if you are suffering from active TB, you might have to take drugs for 6 to 9 months. It is important to complete the full course of antibiotics, even if the symptoms go away, because if you stop taking the medication too soon, the bacteria can survive and become resistant to antibiotics.

Prevention

The best way to prevent TB is to get vaccinated if it is deemed necessary – for example, if you are traveling somewhere with a high volume of cases. If you do come in contact with someone with TB, it is important to get tested immediately, so you can begin treatment, and so you know if you need to stay away from other people until there is no longer a risk.

Tuberculosis is a contagious disease, and can be life-threatening if not treated quickly and appropriately, but in most cases, it is treatable, especially when detected early. Treatment and vaccines for TB and other infectious diseases can be expensive, especially if you don’t have health insurance, or if you don’t have a comprehensive plan. If you’re in this situation, EZ can help: we offer a wide range of health insurance plans from top-rated insurance companies in every state. And because we work with so many companies and can offer all of the plans available in your area, we can find you a plan that saves you a lot of money – even hundreds of dollars – even if you don’t qualify for a subsidy. There is no obligation, or hassle, just free quotes on all available plans in your area. To get free instant quotes, simply enter your zip code in the bar above, or to speak to a local agent, call 888-350-1890.