There are a lot of choices when it comes to Medicare Supplement Plans. You not only have the choice between 10 different letter plans, but you also have the choice of multiple companies to buy your plan from. There’s Aetna, Cigna, Humana, Mutual of Omaha, and so many more. But which one in this sea of companies should you go for? First you need to determine which companies service your area. Next, you need to check each company’s ratings. At EZ, we have agents who can find the company that best fits your needs, so you can get the best possible plan and service.

How Companies Are Rated

Ratings for insurance companies that offer Medicare Supplement Plans are not based on the coverage that their plans offer. This is because Medicare Supplement Plans are standardized by Medicare, so each insurance company has to offer the same benefits for each letter plan across the board. Insurance companies can, however, set the premiums for their plans, so those vary from one company to another. Ratings aren’t generally determined by price alone, though. Insurance company ratings are based on:

- The variety of plans offered. Many companies only offer a limited number of policies out of the 10 different letter plan types.

- Their customer service. This is determined by customer reviews.

- Awards received. Organizations like the Better Business Bureau will sometimes evaluate multiple companies and give awards based on certain factors.

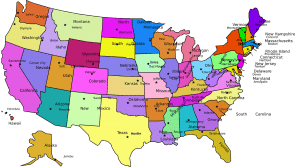

- How many states they offer plans in. Some companies only offer plans in a handful of states, while others serve more areas.

The Top Rated Companies

After evaluating all of the criteria above, we have determined that the top 5 Medicare Supplement insurance companies are:

- Humana– Covers all 50 states, offers plans A,B,C,K,L,N, and has the best additional member benefits. This company generally uses attained-age pricing, meaning premiums increase as you age, and premiums depend on your location, age, tobacco use, and gender. They offer small discounts to those who are living with another senior member who has one of their Medicare Supplement Plans.

- Aetna- Covers 42 states, offers plans A,B,G,N, and is rated best for customer service. Aetna generally uses attained-age pricing, so premiums increase as customers age. They also offer a 12-month rate lock, which guarantees that your premiums will not go up in the first year. They offer a 12% discount for customers who live with another senior who has one of their Medicare Supplement Plans.

- Cigna– Covers 50 states, offers plans A,B,C,D,G,N, and has been rated the best overall value for the plans they offer. They do not require customers to use an in-network doctor, and they offer competitive premiums and some of the most affordable options. They offer a 7% discount for customers living with one other person that is enrolled in one of their Medicare Supplement Plans.

- AARP– Covers 50 states, offers plans A,B,C,G,K,L,N, and is rated the most experienced in working with seniors. To qualify for a plan, you must be an AARP member. Their plan prices are community-rated. They offer an enrollment discount in most states of up to 30% for seniors aged 65, and they offer a 5% discount when more than one person in the household is enrolled in one of their plans.

- Mutual of Omaha– Covers 50 states, offers plans A,G,N, and is rated the most experienced in working with the Medicare system; they have been offering Medicare Supplement Plans since 1966. Their plans usually use attained-age pricing, so premiums increase as customers age. They offer a 12% discount if you live with one other person (over 60 years old) that is also covered by one of their plans.

If you are interested in getting a plan from a top-rated Medicare Supplement company, EZ can help. We work with all of these companies, and more, and we will provide you with a highly trained licensed agent who works with these companies. Your agent will compare all available Medicare Supplement Plans to find the best one for you. You deserve the best, so we’ll make sure you get the best. To get free Medicare Supplement Plan quotes, enter your zip code in the bar above, or if you prefer to speak to an agent directly, call 888-753-7207. Our agents are ready to help!