Medicare Assignment

There’s no guarantee that a doctor or hospital will only charge Medicare-approved amounts for their patients just because they take Medicare patients. All of the services and procedures that Medicare agrees to pay for have set prices that they will pay. In other words, the medical service provider must “accept Medicare assignment”. Which means they agree to take the Medicare-approved amount as payment for the service or equipment. After that, the provider sends a bill for the amount owed straight to Medicare. Medicare usually pays 80% of the bill, leaving the patient to pay the last 20%. If a provider doesn’t “accept assignment,” they can charge up to 15% more than the Medicare-approved amount for Part B.

If you go to a participating provider, all you have to pay for approved services is your Medicare deductible and coinsurance. This is the case even if the provider charges people with other types of health insurance more. Your participating provider will also send your bills to Medicare.

There are also providers who won’t take Medicare assignment. These are called “nonparticipating providers.” If your provider doesn’t participate, they might or might not agree to accept Medicare assignment for specific services. There are usually limits on how much doctors and other medical workers can charge when they don’t accept Medicare assignment. However, there is usually a limit on how much more they can charge for the service.

Medicare Part B

The Part B deductible must be paid before Part B will pay for most medically necessary treatments during the year. For most covered services, you have to pay 20% of the cost out of pocket through Part B. Part B of Medicare also covers services and care that keep you from getting sick. Such as cancer and some other diseases’ screenings, tests, shots, and guidance. For most preventive services, you don’t have to pay anything, but for most medically important services, you have to pay 20% of the cost.

How Much Is The Excess Charge?

“The limiting charge” is the most that non-participating providers can charge you for some medical services and products that Medicare covers. This limit says that Medicare-accepting providers who are not participating can charge you up to 15% more than Medicare’s amount for the same services. This is an example: Medicare has agreed to pay providers $300 for a service you need. Your provider won’t work with Medicare, and they’ll charge you the full legal amount, which is 15%. In this case, the extra charge for you would be $45.

In another instance, Medicare pays $100 for another service you receive. Your provider doesn’t take Medicare assignments, but they’ll only charge you an extra 6%. In this case, the extra charge is $6. It’s important to note that not all services have a limit and there is no cap on how much non-participating suppliers of durable medical equipment can charge you for goods and equipment. Make sure your doctor accepts assignments before you get any durable medical equipment.

How Common Are Excess Charges

A 2020 issue report from the Kaiser Family Foundation says that 99% of doctors who aren’t pediatricians accept Medicare. Also, 98% of doctors who take Medicare are participating providers, which means that most Medicare-approved visits shouldn’t have an excess charge. Although there are many medical providers in the United States, even a small number of providers who don’t accept assignments can add up. This is why you should always check with your provider to see if they take assignments before making appointments or buying medical supplies and equipment.

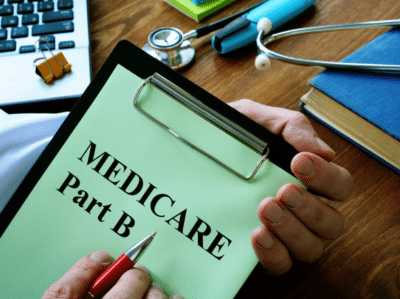

Does Every State Allow Excess Charges?

- Connecticut – People who are in the Medicare Savings Program at the Qualified Medicare Beneficiary (QMB) level are the only ones who can’t be charged extra. Everyone else in Connecticut who has Medicare Part B can face excess charges.

- Massachusetts – Balance billing is illegal in the state, so doctors who take Medicare can’t charge their patients more than the approved amount.

- Minnesota – Under Minnesota law, Medicare excess charges are not allowed. However, there is an exception that ambulance services and medical equipment are able to have excess charges.

- New York – The Balance Billing Law of New York says that excess charges can’t be more than 5% above what Medicare allows.

- Ohio – Excess charges are prohibited in Ohio.

- Pennsylvania – Pennsylvania does not allow excess charges.

- Rhode Island – This is another state that does not allow excess charges.

- Vermont – This state also prohibits excess charges entirely.

How Excess Charges Can Affect You

Say you go to a doctor who isn’t a participant to get a few moles removed that look odd. Medicare will only pay $400 for this treatment, so the dermatologist could charge you $460. If you’ve already met your Part B deductible, the treatment would cost you $140 out of pocket. This includes your $80 coinsurance payment of 20% plus the $60 Part B extra charge. With a participating provider, the most you would have to pay out of pocket is $80. It’s important to remember that excess charges do not count toward your Part B payment.

However, a doctor who isn’t participating can add extra charges to your bill as many times as they want. If you often see a provider who doesn’t take assignments, you could end up paying hundreds of dollars more each year than you should.

Medicare Supplement Plans That Cover Excess Charges

The main thing that makes Plan F better than other Medicare Supplement plans is that it pays for the yearly Medicare Part B deductible. However, in 2015, this changed. People who became eligible for Medicare after January 1, 2020, can no longer get Plan F. People who already had Plan F before the change have the option of keeping it. If you could have gotten Medicare before January 1, 2020, but chose not to, you might also still be able to sign up for Plan F.

Plan G is now the most popular Medicare Supplement Insurance plan that anyone, regardless of when you enroll in Medicare, can get. Plan G pays for the “gaps” in Medicare benefits, which are the costs you have to pay for yourself after Medicare pays its share of the bill. More of these costs are covered by Plan G than by any other Medicare Supplement Insurance plan for new Medicare users.

Why Is Plan F Discontinued?

The Medicare Access and CHIP Reauthorization Act (MACRA) was signed into law in 2015. This law made it illegal to sell any Medicare Supplement plans that covered Part B deductibles for people who became eligible after January 1, 2020. There are only 2 of 10 Medicare Supplement Plans that have this benefit, Plan F and Plan C. The new law did not change anything about the plans themselves. If you had or were eligible for one of these plans before January 2020 then the coverage is still the same. The only thing that changed was that new enrollees can no longer purchase the plans and eventually the plans will be entirely phased out once nobody on Medicare is eligible or has one of these plans.

Working With EZ

It is very important to compare the pros and cons of each Medicare Supplement Plan before choosing one. That takes a lot of work because you have to call a lot of insurance companies to get rate quotes, which can take a long time. You can check prices in half the time if you work with an EZ agent. When you work with a qualified agent, you can compare Medicare Supplement Plans from a number of different companies and plans all in one place.

Your agent can tell you about the changes between each plan and compare prices for you. Your adviser can also help you compare out-of-pocket costs and premium costs to find the plan that will save you the most money in the long run. Call us at 877-670-3602 right now to start looking for a Medicare Supplement Plan. To see online quotes you can also type your zip code into the box below.