You might be surprised to learn that having the right coverage can save you hundreds of dollars each year. Your age, where you live, and which plan and insurer you choose all have an impact on the cost of your Medicare Supplement Plan. However, truth is that not purchasing one of these plans will mean you’re actually wasting money. Let us show you some of the money-saving and health benefits you could be missing out on.

Jump To:

-

What Are Medicare Supplement Plans and Why Do You Need One?

-

The Types of Medicare Supplement Plans

-

How Much Can You Save?

-

How Else Can a Medicare Supplement Plan Help?

-

Value and Peace of Mind

What Are Medicare Supplement Plans and Why Do You Need One?

Medicare Supplement Plans play a critical role in keeping millions of elderly and disabled people healthy and financially secure. You might be thinking: doesn’t Medicare do that already? Well, it’s important to remember that, while Medicare Parts A and B cover a lot. Including most out-patient medical services (Part B) and hospital care (Part A), they don’t cover everything completely. You will still be responsible for a portion of the cost of most of your care. Including copays, coinsurance, and deductibles.

For example, Medicare Part B covers things like doctor visits and other out-patient care. But it only 80% of the Medicare-approved cost of treatment. That means you’ll have to pay the remaining 20% out-of-pocket, which can get expensive.

That’s where Medicare Supplement Plans come in. These plans are intended to cover the “gaps” in your coverage, or your out-of-pocket expenses. So, with one of these plans, you’ll pay a low monthly premium. In exchange, you’ll have things like your Part B 20% coinsurance, deductibles, and/or even skilled nursing care or excess hospital days covered.

All of this means that having a Medicare Supplement Plan can give you significant savings. Especially if you see your doctor often or have frequent hospital stays. So, should you purchase one? The answer is most likely yes. However, to show you how much you could be saving, try subtracting the cost of a Medicare Supplement Plan’s premiums from your total out-of-pocket medical expenses. To find out how much you would likely pay for a plan, talk to an EZ agent for your free, instant quotes.

The Types of Medicare Supplement Plans

One of the many benefits of Medicare Supplement Plans is that there is a wide variety of plans to choose from. So, you’re sure to find one that works for you and your budget. In fact, there are 10 types of Medicare Supplement Plans. Each with different benefits and levels of coverage. So, you can find a plan that fits your needs without having to pay for extra coverage you may not need.

Keep in mind that Medicare Supplement Plans are divided into different lettered plans (Plan A, Plan B, etc.). Whereas Original Medicare is divided into lettered parts (Part A, Part B, etc.). So, don’t confuse Medicare Supplement Plans with Original Medicare’s parts.

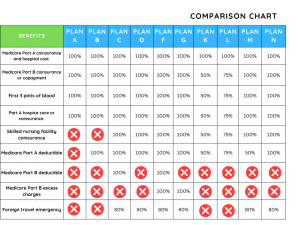

With that being said, the following is a brief overview of what each plan covers. And see our chart below for a handy comparison of what would be covered with each type of plan:

- Plan A – Medicare Supplement Plan A is the most basic plan available. But even though it’s basic, it will cover what is arguably the most important thing that Medicare Supplement Plans cover: the 20% of outpatient treatments that Medicare does not cover. All Medicare insurance carriers have to offer Plan A. However, some states do not require insurers to offer this plan to people under the age of 65 who are on Medicare disability.

- Plan B – Medicare Supplement Plan B covers everything that Plan A does. Plus the Medicare Part A hospital deductible.

- Plan C – This is one of the most complete Medicare Supplement Plans available. Plan C covers everything except Medicare excess charges. This means that it covers both your Parts A and B deductibles, as well as the 20% coinsurance you would normally owe for all outpatient treatment.

- Plan D – Plan D covers the majority of medical expenses, but does not cover the Part B deductible or any Medicare excess charges.

- Plan F – Medicare Supplement Plan F has long been the best-selling plan on the market. It covers all of your out-of-pocket expenses. Meaning you’ll only pay your monthly Plan F premium if you have this plan. The only catch is that Plan F is not available to anyone who became/becomes eligible for Medicare after 2020. If you became eligible for Medicare before 2020, you can purchase one of these plans. Or if you have already purchased Plan F and are grandfathered in, you can keep it as long as you want.

- Plan G – If you like the sound of Plan F, but are not eligible to purchase one of these plans, look into Plan G. This plan covers everything that Plan F does, except for your Part B deductible. And the good news is that Plan G premiums are frequently very competitive. Making these plans a better value than Plan F.

- Plans K, L, and M – These plans all cover various percentages (as shown in the table below) of what the other plans cover. They do not cover Part B deductibles.

- Plan N – This plan offers lower premiums in exchange for copays for certain services, such as doctor and emergency room visits. It does not cover Medicare excess charges.

When comparing Medicare Supplement Plans and prices, keep in mind that plans are standardized. So while each insurance company sets its own prices, the benefits for each plan will be the same regardless of which insurer you purchase it from. Knowing this will allow you to easily compare prices between policies.

How Much Can You Save?

The answer to how much a Medicare Supplement Plan can save you differs for each individual. These plans will, at the very least, as noted above, usually cover coinsurance and copays. That means, for example, every time you see the doctor or receive outpatient treatment, you won’t have to pay the 20% coinsurance you would have to pay without a Medicare Supplement Plan. This can really add up. So, your savings will most likely outstrip the amount you’ll spend on your plan’s monthly premium.

And if you have an emergency medical situation, a Medicare Supplement Plan can help you save hundreds of thousands of dollars. Especially if you need to stay in the hospital beyond the number of days that Medicare Part A covers.

But to see more specifically how much you might save, review your medical bills for the year. It’ll be even easier if you are currently enrolled in Medicare. The Medicare Summary Notice you receive each quarter can assist you in figuring out how much you’ve been paying out-of-pocket. Including on deductibles, copayments, and coinsurance. And then speak to an EZ agent about your personalized quotes!

How Else Can a Medicare Supplement Plan Help?

There are other ways that a Medicare Supplement Plan can help. Especially when it comes to specific situations that many older adults will often find themselves in. For example:

- Are you planning on spending your retirement years traveling? Many Medicare Supplement Plans will cover at least a portion of emergency medical costs in a foreign country, which is something that Original Medicare does not cover.

- There might come a day when you need extra care following an injury or illness. And Medicare will not generally cover care at a skilled nursing facility. But most Medicare Supplement Plans cover the costs of skilled nursing facilities. Which could mean significant savings for you and your loved ones. In fact, if you need to be in a skilled nursing facility for more than 20 days, a Medicare Supplement Plan could save you thousands of dollars.

- Long hospital stays aren’t inevitable. But if you find yourself in need of longer-term care in the hospital, you’ll save a lot with a Medicare Supplement Plan. After your Medicare Part A hospital benefits are exhausted, your Medicare Supplement Plan will pay for up to 365 more days in the hospital.

- While Part B covers a portion of the cost of durable medical equipment (DME), such as wheelchairs, you will have to pay for part of these expensive pieces of equipment out-of-pocket. But a Medicare Supplement Plan will cover the costs you would otherwise have to bear.

Finally, another great benefit of Medicare Supplement Plans is that these policies allow you to see any doctor who accepts Medicare. Meaning you will be able to choose from hundreds of providers across the United States. If your doctor accepts Medicare, they will also accept your Medicare Supplement Plan.

Value and Peace of Mind

Medicare is great. It’s kept countless older adults healthy, and even saved them from sinking into poverty because of medical expenses. So, if you’re wondering why you should purchase a separate policy when you already have Original Medicare. It’s important to look at the value of a Medicare Supplement Plan, and how much you’ll save in the long run with one.

If you break down the overall price of a Medicare Supplement Plan versus not having a plan and facing a medical emergency, it definitely pays to have the protection. Medical emergencies can bankrupt a family. Even those who are covered by Original Medicare. And that is the last thing you’ll want to worry about in that situation!

To save as much money as possible, it’s worth looking into a Medicare Supplement Plan. Speak with an EZ agent about all of your options. EZ’s agents work with the best insurance companies in the country. This lets them compare plans for you in minutes at no cost. To get free instant quotes, enter your zip code in the sidebar, or call a licensed agent at 877-670-3602.