Osteoporosis affects around one in three women, and one in five men, over the age of 50, meaning that more than 200 million people are suffering from osteoporosis in this country. There are many different kinds of treatments available for osteoporosis, with the current standard treatment being bisphosphonates. There is, though, another drug called Prolia, which clinical trials have found is just as effective as bisphosphonates. How these treatments work differs, so if bisphosphonates aren’t working for you, you might want to talk to your doctor about Prolia. Fortunately, Medicare does cover Prolia, so if this drug is right for you, you will be able to start your journey to healing with the help of Medicare.

How Prolia Works

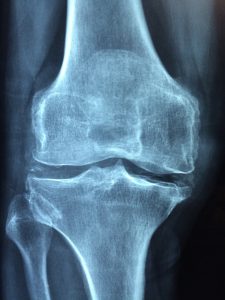

Osteoporosis is a condition that causes your bones to become thin and weak; it typically affects women more than men. Some common symptoms of osteoporosis can include brittle and weak nails, receding gums, and weakened grip strength.

Prolia is a prescription drug that’s used to treat osteoporosis and other forms of bone loss. It works by stopping bone cells from breaking down and by further strengthening the bone. It is given as an injection in the side, upper arm, or belly. Prolia is generally used to treat osteoporosis in individuals who are post-menopausal, and at high risk for bone fractures.

“This drug works by preventing the osteoclasts from maturing or resorbing bone, so it’s a completely different mechanism of action [from that of bisphosphonates]. That said, it appears at the end of the day, in terms of reducing fractures and making bones stronger, the result is about the same as bisphosphonates,” says Nancy E. Lane, MD, director of the Center for Healthy Aging at the University of California, Davis.

The Price of Prolia

The cost of any prescription drug depends on various factors, including the type of coverage you have in addition to Original Medicare. Most Medicare plans will cover Prolia, but it depends on how you take the drug. If you have Original Medicare and self-administer the injection, a Part D plan should cover the cost. But if you have original Medicare and a home health nurse administers your injection, Part B will cover 80% of the cost of the drug, leaving you to pay the other 20% out-of-pocket.

Medicare Eligibility For Prolia Coverage

While Medicare will usually cover Prolia, there are some criteria. To be Medicare-eligible for osteoporosis drugs in general, you must:

- Be a woman

- Have a bone fracture that a doctor has certified is related to postmenopausal osteoporosis.

Is Prolia Right For You?

As with any drug, you should ask your doctor about the benefits and the risks of Prolia, especially if you have any of the following issues:

- Thyroid disease

- Kidney disease- Kidney problems can cause low calcium levels, and treatment with Prolia can further lower your calcium levels, which can be dangerous.

- Low calcium levels- Same as above. Your doctor might recommend that you increase your calcium levels before you begin taking the drug.

- Weakened immune system

- Trouble absorbing minerals

In addition, it is important to notify your doctor about any medications you are taking regularly, including over-the-counter medications, so they can inform you of any interactions between these medications and Prolia.

Extra Coverage

If you are interested in receiving the Prolia injection but are afraid of having to pay 20% out-of-pocket every time you get an injection, it might be time to look for extra coverage. Your 20% coinsurance can really add up, especially if you are living on a fixed income, as many Medicare beneficiaries are. Fortunately, though, you can save money on all of your medical expenses and get extra coverage by purchasing a Medicare Supplement Plan.

There are 10 different Medicare Supplement Plans to choose from, each offering different coverage options and rates. It’s worth looking into a Medicare Supplement Plan to save as much money as you can, so speak to an EZ agent for all of your options. EZ’s agents work with the top-rated insurance companies in the nation and can compare plans in minutes for you at no cost. To get free instant quotes for plans that cover your current doctors, simply enter your zip code in the bar on the side, or to speak to a licensed agent, call 888-753-7207.