Organize and Budget Gifts

Organization will liberate you! Do you believe you have an insurmountable task list? As with the previous step, break them up. It will stress you out much more if you have this cloud of ideas flying about in your head. If your budget is limited, it is okay to decline gift exchanges. Instead of buying gifts for everyone, encourage them to give to charity, make a homemade gift, or organize a low-cost activity for you all to do. If traveling is too expensive for you, ask family or friends to contribute to the cost of the ticket rather than giving you gifts. If you are unable to attend, request to skype or FaceTime with the individual or persons so that you can still participate in the festivities. Plan your budget ahead of time so you know what you can afford. Here’s what to do:

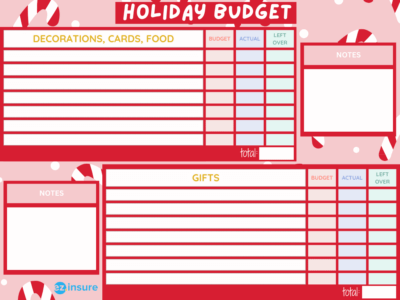

- Make your list – List out the names of people you’ll be seeing during the holidays that you want to buy gifts for.

- Organize by priority – Once you can physically see the list, rearrange it by priority whether it be kids first, then immediate family, followed by extended family or just by the order that you plan on seeing them in.

- Pick the presents – You can begin assigning present ideas to each person once you’ve determined who you’ll be buying things for. If the process starts to become stressful , brainstorm with some hot cocoa and/or play some soothing music like jazz or holiday-themed songs.

- Set realistic goals – You probably have a reasonable estimate of your budget for these things, but price each item separately and sum it up. It is easier to plan when you have specific numbers to work with.

- Finalize it – Top off the whole process by turning all of your information into a checklist, you can even put the dates you’ll be seeing each person to give yourself a little deadline. This way you can mark off the gifts as you go so you don’t forget anything.

It’s Okay To Say No

The holidays may be stressful, especially if you commit to too many gatherings or have unreasonable expectations. When you say yes when you should say no, it merely leads to a flood of overwhelming and resentful feelings. With work and limited vacation time, your schedule is already packed. Don’t try to be in too many places at once since you won’t be able to appreciate your time. You’ll be too preoccupied with getting to the next party or worrying about hosting your own. Take it at your own speed and learn to say no.

You can decline invitations to some gatherings in order to spend more quality time with the people you do prefer to visit. Set priorities and stick to your budget. Take the previous checklist and replace the gifts with family members you want to see. Instead of gift pricing, assign trip prices to each one. If you are unable to accommodate everyone, make plans to visit once the holiday rush has subsided. They’ll probably understand, and also appreciate the break from the hustle and bustle. Visiting after the holidays may end up being more of a gift to everyone involved.

Don’t Overindulge

Consider all of the pastries and snacks you’ll be eating and drinking throughout the holidays! Our eating habits are tested over the holiday season, with dinners, parties, and cookie tables at every turn. Overindulging can make you feel tired or sluggish. It can also cause you to gain an unhealthy amount of weight, adding to your mental stress. Take a brief walk to get some exercise. Allow yourself time to be active so that you can appreciate all of the delicious treats. Attempt to maintain a healthy diet. Consuming whole grains, vegetables, and fresh fruit is the foundation for a healthy body and mind. Eating well can also aid in leveling out your mood.

Make Self-Care A Priority

This is more than just meditation. If you have a fitness routine, don’t let it slip during family visits. Try to go to the gym or perform some home exercises. Sticking to your routines (whether self-care or otherwise) not only gives you a mental lift, but it also establishes an internal norm. You’re going to dedicate your time and energy to people you care about this Christmas season, but don’t lose sight of yourself in the process. Keep your feet on the ground. Make time for activities that make you happy. It could be reading a book, going to the movies, having a massage, listening to music, or walking your dog. It is okay to prioritize alone time when you need to refuel.

Don’t Isolate Yourself

Some people may experience loneliness during the holidays, but if you don’t want to be alone, you don’t have to be. You can join an organization, volunteer at a soup kitchen, attend community events, and meet new people. Volunteering can be a wonderful source of comfort. You can feel less lonely or isolated and more connected to your community by assisting those who are less fortunate. Start a toy or food drive and invite your neighbors, friends, and coworkers.

Be Present

Have a two-week trip planned to see relatives? Take everything one day at a time. This can work even if you are not staying for an extended period of time. One hour, one minute, one second at a time. Simply concentrate on the subject at hand and give it your undivided attention. Don’t be concerned about the rest of it. It is beneficial to employ these bite-size moments during stressful periods. Pay attention in the present moment. If you spend too much time thinking about future occurrences, you will become more stressed in the present.

Seek Professional Help

If you’re feeling overwhelmed, speak with your mental health practitioner. They can assist you in identifying particular circumstances that trigger you and develop an action plan to modify them. Keep seeing your therapist if you’re already seeing one. If you’re not already seeing one your health insurance will actually cover some mental health services due to the Mental Health Parity Act.

The Mental Health Parity Act requires insurance companies to handle coverage for mental and behavioral health and drug use problems in the same way that they treat coverage for medical and surgical care. This includes treating them equally in terms of money. For example, an insurance company cannot charge a $40 payment for a mental health professional’s office visit when most medical office visits only require a $20 copay.

In addition, the Affordable Care Act also provides protection for mental health services. Mental health is covered as an essential health benefit in all ACA-compliant plans. As with other medical illnesses, your plan should cover some or all of the cost of mental health care. All ACA-compliant plans must include the following mental health services:

- Outpatient individual or group counseling and therapy

- Diagnostic services like psychological testing and evaluation

- Ongoing outpatient treatment such as treatment programs and medication management

- Outpatient treatment for alcohol or chemical addictions

- Detox services

- Substance abuse recovery treatment

- Inpatient mental healthcare in a psychiatric facility

Work with EZ

Any visit has the potential to cause family turmoil. You want your parents/relatives to have a good time and enjoy your visit, but the holidays may bring a whole new level of stress to the situation. Maintaining excellent relationships with friends and family has surprising health benefits, so these trips are well worth it in the long term. Just keep these pointers in mind, and you should be okay. As for finding health insurance to cover your mental health, consider us Santa’s helpers. A licensed EZ insurance agent can explain the advantages and disadvantages of each plan, while also helping you in developing the plan that is ideal for you.

Working with an agent saves you time and stress because you won’t have to decipher legal language or read fine text. Agents perform all of the heavy lifting, so you can relax knowing that your coverage is tailored to your specific financial and medical needs. Not to mention that EZ agents can save you hundreds of dollars on health insurance rates each year. We accomplish this by being able to search both on and off the market for the most cheap plans.

We can also locate and apply any discounts you may be eligible for. Also,we don’t simply provide you a strategy; we also aid you in maintaining it after the fact! We can assist in filing claims with your provider as well as renewing your coverage when the time comes. To get a quote, enter your zip code into the box below or call one of our qualified representatives at 877-670-3557.