In 2014, the Affordable Care Act established the premium tax credit so that individuals or families with low or moderate income can be able to pay for health insurance through the Health Insurance Marketplace. Premium tax credits help you pay for a portion of your monthly cost of insurance premiums. Individuals and families must meet an income requirement to enroll in a health insurance plan through a state-operated insurance marketplace, or a federally-operated marketplace.

Qualifications

- You must prove you do not have access to an affordable employer-sponsored program. This plan must meet minimum essential coverage meaning the employee contribution does not exceed 9.5% of the employee’s income.

- You must prove you are not eligible for Medicare, Medicaid, or TRICARE

- You cannot be claimed as a dependent by another taxpayer.

- In the same month, you or a family member must have health coverage through a Health Insurance Marketplace.

- You file a joint federal income tax return if you are married; you cannot file married filing separately tax return (unless a victim of domestic abuse or spousal abandonment).

- Have a household income that falls within a certain amount.

Income Requirements

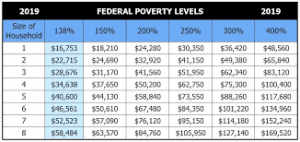

In order to be eligible for the premium tax credit, you and your family size must be at minimum 100 percent below the poverty line, but no more than 400 percent. This means the income must be between $12,060 and $48,240 for an individual and between $24,600 and $98,400 for a family of 4 in 2018.

The amount of tax credit is based on a sliding scale. This means the lower your income, then the larger credits you receive. If your income changes, then the amount of assistance you qualify for will change as well.

It is important to keep an eye on your household income and how much tax credit you receive. If the advance credit payments are more than the allowed credit, then you will have to repay some or all of the extra earnings. If your household income is more than 400% of the federal poverty line for your family size, then you are not allowed a premium tax credit. You will have to repay all of the advance credit payments.

Advance Tax Credits

A taxpayer can either choose to receive advanced payments, which is paid to the insurance company to lower monthly premium costs, or the taxpayer can wait to get all of the credit when they file their tax return. Eligibility for the advanced payments is determined when purchasing coverage through the marketplace. There is a difference between advance payments to your insurance company and your allowable premium tax credit amount. Form 8962 calculates your tax credit amount that is allowed when you file your tax return.