If you’re planning to enroll in health insurance for yourself or your family, it’s important to know who manages your state’s health insurance exchange—because it can affect how and when you enroll, what plan options are available, and what subsidies you may qualify for.

Under the Affordable Care Act (ACA), each state has the option to run its own health insurance marketplace, or to use the federally facilitated one through HealthCare.gov. As of 2025, some states operate fully state-run marketplaces with their own websites, deadlines, and plan offerings—while others rely on the federal government’s platform.

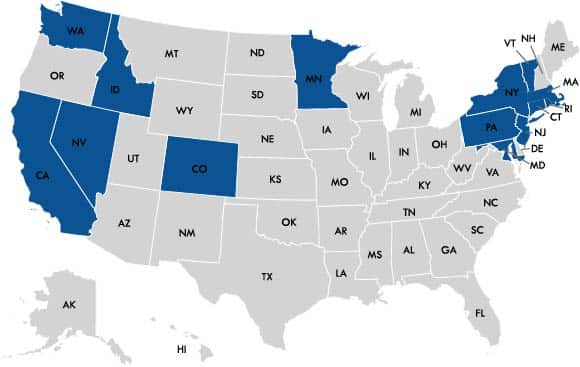

State-Based Marketplaces vs. Federally Facilitated Marketplaces

When the ACA was passed in 2010, it gave states the opportunity to build and manage their own health insurance exchanges. If a state declined, the federal government would step in and provide ACA-compliant plans through HealthCare.gov.

Today:

-

20 states (plus Washington, D.C.) run their own marketplaces

-

3 states use the federal platform for enrollment, but manage their own backend operations

-

The remaining 28 states use the federally facilitated marketplace

State-based marketplaces allow local governments more control over how plans are regulated, priced, and promoted. They can also set their own Open Enrollment Period (OEP) dates, which is helpful for residents who need more time to enroll.

States That Operate Their Own Health Insurance Exchanges (2025)

Here are the states that currently operate their own health insurance marketplaces, along with their platform names:

-

California – Covered California

-

Colorado – Connect for Health Colorado

-

Connecticut – Access Health CT

-

District of Columbia (D.C.) – DC Health Link

-

Idaho – Your Health Idaho

-

Maryland – Maryland Health Connection

-

Massachusetts – Massachusetts Health Connector

-

Minnesota – MNsure

-

Nevada – Nevada Health Link

-

New Jersey – Get Covered NJ

-

New York – NY State of Health

-

Pennsylvania – Pennie

-

Rhode Island – HealthSource RI

-

Vermont – Vermont Health Connect

-

Washington – Washington Healthplanfinder

Each of these states may offer unique plan choices, local insurer options, and extended enrollment deadlines beyond the federal window.

When Is Open Enrollment for ACA Plans in 2025?

The federal Open Enrollment Period for 2025 coverage is expected to run from November 1, 2024 through January 15, 2025. However, some state-run marketplaces set their own deadlines and may offer enrollment extensions.

What If You Miss Open Enrollment?

If you don’t enroll during the Open Enrollment Period and don’t qualify for a Special Enrollment Period (SEP), you may have to wait until the next OEP begins in late 2025. Here’s what happens if you don’t take action before the deadline.

Common SEP triggers include:

-

Loss of other coverage

-

Marriage or divorce

-

Birth or adoption of a child

-

Moving to a new ZIP code or state

Why Does It Matter Who Runs Your Marketplace?

If your state uses a state-based marketplace, your:

-

Enrollment dates may be longer or more flexible

-

Health insurance plan options may be broader or include regional carriers

-

Application process may take place on a different website (not HealthCare.gov)

Looking for Health Insurance?

The best way to get the right plan for your needs is by working with a licensed health insurance agent. At EZ, our team:

-

Works with top-rated insurance companies in every state

-

Can help you access premium subsidies and tax credits

-

Will walk you through all your health insurance options—federal and state-based

-

Does all the heavy lifting for you—at no cost

To get free instant quotes, simply enter your ZIP code in the bar above, or to speak to a local agent, call 888-350-1890.