If you own a business that employs fewer than 50 people, then you are not required to offer your workforce group health insurance – but that doesn’t mean that you can’t, or that you shouldn’t. Many small business owners find that having healthier and happier employees is worth the cost and the administrative headaches of providing a healthcare plan, some go even further: they offer multiple plan options for their workers to choose from. Going this route may not be right for every small business, but if you’re looking to keep a diverse workforce satisfied, then it might be right for you.

Offering Health Insurance: The Stats

If you’re not currently offering a healthcare plan to your employees, you may want to take a look at a few stats:

- 40%: The percentage of workers that say that healthcare is their number one priority when it comes to benefits.

- 88%: The percentage of job seekers who say that they would give health benefits “some consideration” or “heavy consideration” when choosing a job. 46% said it was a deciding factor.

- 56%: The percentage of people with employer-sponsored health benefits who say that whether or not they like their health coverage is a key factor in deciding to stay at their current job.

- 50-60% of a worker’s annual salary: The amount it can cost to find a direct replacement for them if they leave their position.

- $4,000: The average amount it takes to hire an employee.

The numbers above should give you an idea of how important offering group insurance to your employees can be to recruiting, retention, and to your bottom line. Adding flexibility to your plan options can only increase those benefits.

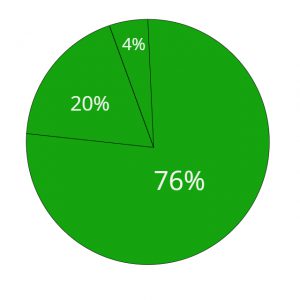

If you are currently offering one type of insurance plan to your employees, then you’re not alone. According to the Kaiser Family Foundation 2019 Health Benefits Survey:

- 76% of small businesses offer one plan type

- 20% offer two plan types

- 4% offer three or more plan types

If you’re choosing between plan types, you might want to take a look at a breakdown of what other small employers are choosing:

- Point of Service (POS) plans: almost half of small employers – 47% – chose this option, according to a recent survey. POS plans are a hybrid of PPOs and HMOs: they have the lower premiums and primary care physician requirement of HMOs, but are slightly more flexible.

- HMOs: This type of plan, which requires that employees choose a primary care physician, get referrals to see specialists, and stay within a narrow network, accounted for 26% of small business plans

- PPOs: 15% of plans were this more flexible type, which have larger networks and fewer requirements than an HMO, but also have higher premiums.

Offering Plan Options: The Factors

Now that you know all the relevant facts and figures, and we’ve established that offering at least one plan is a good idea, let’s take a look at the factors that should go into determining whether you decide to offer more than one plan type.

- The ages and health needs of your employees: If you’ve got a workforce completely populated by Millennials or X-ennials who are single, childless, and healthy, then offering a one-size-fits-all high deductible health plan might be a great choice for you. You and your young, healthy employees could both save money on premiums, and they could contribute money tax-free to an HSA. But if you have some older employees, or employees who need to visit their doctor often, then they would probably prefer a plan with a higher premium and lower deductible. Adding a PPO into the mix would probably work for them, especially because they might not want to have to see their primary care physician every time they need to visit a specialist.

- Location: If your employees all live and work in one small area, then they might not need to pay extra for a PPO with a wide network. However, if you have a lot of commuters who are spread out over a large area, they may prefer the flexibility of a plan with a larger network.

- Budget: You need to think about what both you and your employees can afford when it comes to choosing a plan. If you really can’t find it in your budget to contribute to higher premiums plans, then stick with offering a cheaper option – it’s better to offer one plan than no plan! On the other hand, if most of your employees are older and/or have families and are willing to pay for a more full-coverage plan, but you have a few younger, more budget-conscious employees, consider offering them a second, cheaper option.

There’s always a lot to consider when choosing whether – and how – to offer health insurance to your small business’s employees. If you need more input, turn to your employees themselves – you can always offer an anonymous employee healthcare survey so that they can tell you exactly what they want. And if you need still more help, turn to EZ! We can answer all of your questions about offering multiple plans (or anything else!), find you the best plan options, and get you super fast, accurate quotes, and we’ll do it all for free. To get started with us today, simply enter your zip code in the bar above, or to speak with an agent directly, call 888-350-1890.

2 thoughts on “Small Business Owners: Should You Offer More than One Type of Health Insurance Plan?”

While I think that offering multiple plan types is beneficial, not all businesses will have the resources to do so. I think this is where inquiring with employees helps, as it provides businesses with a better understanding of how to craft plans that appeal to everyone.

Agreed, which is why it is important to speak with one of our agents. They will be able to go over all options possible and find a plan that appeals to everyone and is within the business owner’s budget!