Let’s Talk About Workers’ Comp—What It Really Covers

When you’re running a business, keeping your team safe isn’t just the right thing to do—it’s good business. But even with strong safety practices in place, accidents can happen. That’s where workers’ compensation insurance steps in: to protect your people and your bottom line.

Still, we hear this question all the time from business owners: What exactly does workers’ comp pay for?

Let’s cut through the confusion and get to the core of what workers’ comp actually pays for.

What Does Workers’ Compensation Actually Cover?

Workers’ compensation insurance is there to help cover costs when an employee gets hurt or sick from doing their job. It takes financial pressure off your business, and gives your employee the care and support they need to recover.

Here’s what it typically includes:

1. Medical Expenses

This includes:

- Emergency room visits

- Surgeries

- Physical therapy

- Prescription medications

- Long-term rehabilitation

2. Lost Wages

If your employee needs time off to recover, workers’ comp provides partial wage replacement, usually two-thirds of their regular pay, subject to state-specific limits.

3. Permanent Disability Benefits

When an injury leads to long-term or permanent impairment, workers’ comp can provide long-term or lifetime disability benefits, based on severity and ability to work again.

4. Death Benefits

In the rare and tragic event of a work-related death, workers’ comp provides financial support to the employee’s dependents, covering funeral expenses and a portion of lost income.

5. Vocational Rehabilitation

If your employee can’t return to their original role, workers’ comp may cover training or help them transition into a new position—keeping them employed and productive.

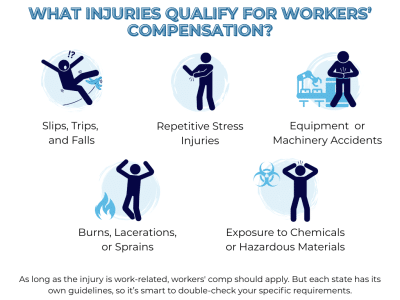

What Injuries Qualify for Workers’ Compensation?

We’re often asked: What injuries qualify for workers compensation?

Here’s the simple rule: If it happens because of work—or while working—it’s usually covered. This includes:

- Slips, trips, and falls

- Repetitive stress injuries (like carpal tunnel)

- Equipment or machinery accidents

- Burns, lacerations, sprains

- Exposure to chemicals or hazardous materials

As long as the injury is work-related, workers’ comp should apply. But each state has its own guidelines, so it’s smart to double-check your specific requirements.

Not sure who needs to be covered? Learn more about workers’ compensation exemptions and whether your business qualifies.

Workers’ Comp by Injury Type: What Gets Paid (and Why It Matters)

According to Bureau of Labor Statistics data, here’s a general idea of what certain types of workplace injuries might cost:

These figures vary by state and industry, but knowing the averages can help you better understand workers compensation insurance rates—and why coverage matters.

What Impacts Workers’ Compensation Insurance Cost?

Let’s talk numbers. Your workers compensation insurance cost depends on a few key factors:

- Your industry: High-risk jobs = higher premiums

- State rates: Rates are set at the state level. If you’re looking up workers compensation rates by state, expect wide differences.

- Payroll size: The more employees and payroll you have, the higher the exposure, and the higher the base cost.

- Claims history: A clean safety record = lower rates.

- Classification codes: Accuracy here is key—it impacts your final rate

- Safety programs: Many carriers offer credits for proactive safety measures

Looking to lower your rate? Check out these strategies that can help you reduce your workers’ comp costs over time Keep in mind, your premium may change after a workers’ comp audit, which reviews your actual payroll and classification codes.

Final Word: Workers’ Comp Isn’t Just a Line Item. It’s Protection.

The bottom line? Workers’ compensation insurance protects your team and your business. It ensures you’re covered when the unexpected happens—whether it’s a sprained back, a machinery mishap, or something more serious.

And the more you know about what it covers, how it’s priced, and how your business fits into the picture, the better equipped you’ll be to choose the right plan—at the right price.

Ready to Take a Closer Look at Workers’ Comp?

We’re here to help you navigate the options, understand your risks, and get coverage that truly fits your business—without the jargon, the fluff, or the sticker shock.

To get a free quote and learn more about your options, simply enter your zip code, or give us a call at (855)-694-0047.

2 thoughts on “What Does Workers’ Comp Actually Cover? Costs, Benefits, and Injury Breakdown”

I currently have Next insurance but no WC yet…

Hi Bryan, if you’re interested in getting another quote for workers’ compensation insurance you can enter your zip code in the box above or give us a call at (855) 694-0047.